Healthcare Technology Insights

Proving the Value of Practice Management in Dental

March 28, 2017

As noted in our recent Industry Perspective, Practice Management 2.0, the resurgence of practice management companies across the specialty practice landscape is on the rise. The dental space, estimated to be a $123.9 billion business in the United States, was featured in our report for its maturity in the proliferation of practice management models. Dentistry and dental practices have had a long-standing and (for the most part) successful history with the utilization of practice management service, through entities typically known as Dental Service Organizations (DSOs). In this blog, TripleTree reviews why the pace of growth for practice management companies is accelerating and how several overarching factors have helped make the capabilities of DSOs stick, including:

- Dentistry is an Attractive Business Model for Practice Management, Plain and Simple. Though highly correlated with the performance of the economy, dentistry has traditionally been one of the most profitable industries in healthcare, with private clinics ranking in the nation’s top five most profitable industries in 2015, achieving an estimated net profit margin of roughly 15%.1 Further, the industry is less dependent on health insurance reimbursement than the healthcare sector as a whole, in which patients largely pay for services and treatments out-of-pocket.

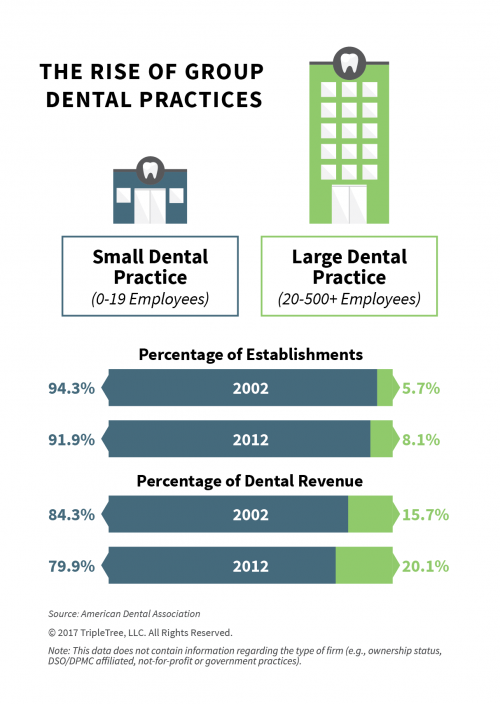

- The Fragmented Dental Provider Landscape Provides Significant Opportunity for Consolidation. The multi-site model of dental practices provides favorable conditions for DSOs to exploit economies of scale across practices and subsequently, experience lower overhead costs while still benefiting from the unique local market characteristics of each practice. The historically fragmented nature of dental providers has provided a significant opportunity for industry consolidation, and DSOs are well suited for continued growth in this environment, through either the acquisition of practices or opening offices de novo. In concert with DSO penetration, practices themselves have experienced significant change, with the increasing concentration of large, multi-site group dental practices.2 While most dentists in private practice today own or share in the ownership of their practice, the industry has seen a continued increase in the rise of group practices since the early 2000s. In 2002 roughly 94.3% of the dental establishments in the United States employed fewer than 20 dental professionals and accounted for 84.3% of dental revenue. In 2012, they made up 91.9% of establishments and generated 79.9% of dental revenue in the U.S. Conversely, dental establishments employing greater than 20 professionals saw an increase in terms of both percentages of establishments, from 5.7% in 2002 to 8.1% in 2012, and in terms of dental revenue, from 15.7% to 20.1%, respectively.3 The increase of larger group practices combined with accelerating market consolidation is forcing traditional dental practices to find new ways to remain viable. While many dental practices have contended with rising dental costs, one way firms have been able to help boost profitability is through affiliation, or acquisition, by DSOs. Many solo practitioners and group practices have formed contracts with DSOs to lower their operational costs by leveraging greater economies of scale. Though dental practice management companies have a growing footprint in the market, there remains significant runway for continued expansion.

- The Supporting Labor Market Continues to Change. The needs and preferences of the clinical labor market are continuing to change. With ever-increasing amounts of student debt saddling recently graduated dentists, joining a DSO presents an attractive option for young physicians looking for stability of employment. According to the American Student Dental Association, the average 2016 graduate will have over $261,149 in debt upon graduation, an increase of more than four times the average graduate debt of $55,000 in 1990. When coupled with the slowing rate of retirement for older practitioners, these economic realities are creating traction for DSOs as younger dentists enter the workforce and begin practicing day-to-day.

- The Continued Rise of DSOs is a Self-Fulfilling Prophecy. The reality of today’s environment is that running a dental practice is more complicated than ever, with dentists and office managers facing an ever-growing list of demands and challenges. DSOs provide dentists with a single source for practice administration by addressing all non-clinical aspects of practice management, enabling dentists to focus on the provision of care. As such, DSO affiliation represents an important option for dentists to consider — both well-established dentists when evaluating their practices’ performance and long-term financial viability, as well as newly trained dentists upon entering the workforce. With the continued rise of DSOs, this option is increasingly relevant and is accelerating acceptance of the model by dentists.

Many DSOs have been formed in response to these factors, and several have significantly expanded their footprint across the U.S., including organizations such as Heartland Dental, Aspen Dental, Smile Brands Group, and Absolute Dental, among others.

As a result of these favorable industry characteristics, the dental space has been a hotbed of activity over the past several years. Read more about how the dental industry continues to grow in TripleTree’s recent Industry Perspective, Practice Management 2.0. In the meantime, we welcome your thoughts about the important role of practice management companies across the dental industry.

Michael, Michael, Evan and Chris

- “The Most Profitable Industries in the U.S.” Sageworks.

- Guay A, Warren M, Starkel R, Vujicic M. ” A Proposed Classification of Dental Group Practices.” Health Policy Institute Research Brief. American Dental Association, February 2014.

- Wall T, Guay A. “Very Large Dental Practices Seeing Significant Growth in Market Share.” Health Policy Institute Research Brief. American Dental Association, August 2015.