Healthcare Technology Insights

Looking Ahead – Virtual Health Transforming Care Delivery

June 1, 2020

The COVID-19 pandemic has exposed a wide range of vulnerabilities across the U.S. healthcare system, from PPE supply shortages and testing issues to gaps in public health policy and population surveillance as the virus continues its spread. Providers have felt the abrupt and immediate financial impact of COVID-19 more than any other constituency. As of March and April 2020, hospital volumes across all specialties and regions were down 54.5% year-over-year, with certain service lines down as much as 70-80%. Ambulatory practices have been similarly hit hard, with visits and revenue down between 60-80%. Some rightly argue that COVID-19 exposes the weaknesses of our fee for service model and providers’ reliance on elective procedures for financial viability. In this regard, the pandemic may ultimately serve as an historical turning point and accelerant for greater adoption of capitated arrangements and other value-based care (VBC) approaches.

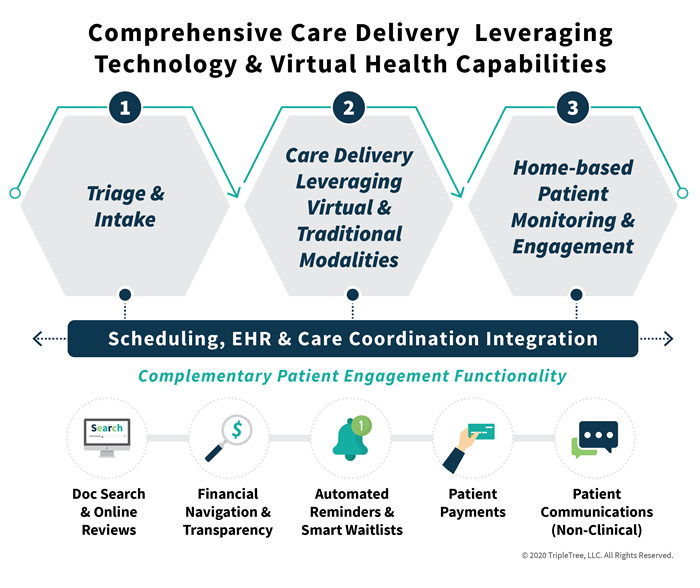

While we support the long-term movement toward VBC, we believe there is a more immediate opportunity to reshape care delivery and create a more efficient and cost-effective healthcare system through the use of intelligent and innovative technology. In this fourth installment of our blog series on the new era of virtual health, we open the aperture to look at the future of access and care delivery across three primary areas:

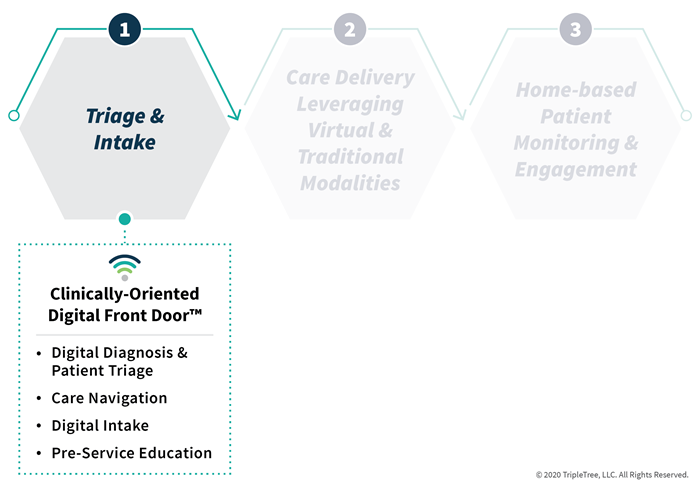

- Clinically-Oriented Digital Front Door™: An amalgamation of intelligent, data-driven capabilities that engage with patients to digitally diagnose, triage, and route them to the appropriate care pathway based on their specific symptoms, care delivery needs, and severity.

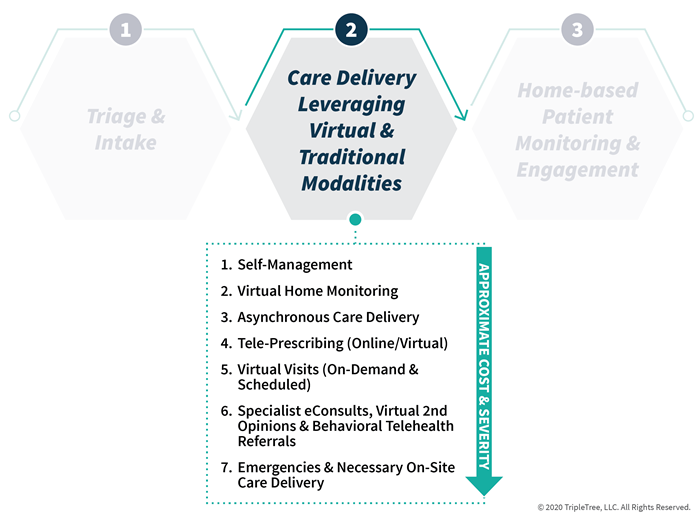

- Customized Care Delivery Leveraging Virtual and Traditional Modalities: Once the patient is triaged, the most appropriate, cost effective care pathway can be determined. Traditional, in-person care delivery certainly has its place, but is often over-utilized relative to the patient’s severity and specific needs and can unnecessarily delay access to care by days or even weeks for certain services. Primary care physicians (PCPs), for instance, are often overwhelmed with patients filling their waiting rooms that could otherwise be treated asynchronously or monitored remotely from their homes. Intelligently steering patients to the proper care delivery modality improves convenience, timely access, and patient satisfaction while allowing physicians to practice at the top of their license and maximizing the economic impact for all constituencies.

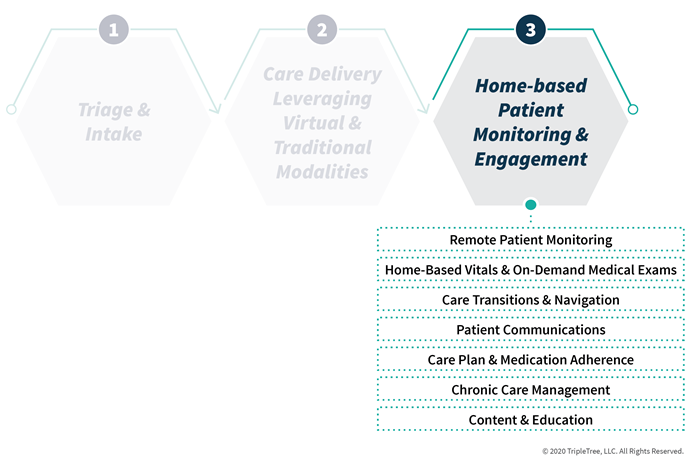

- Home-based Patient Monitoring and Engagement: COVID-19 will serve to accelerate the industry’s trend toward caring for and managing patients from the comfort of their homes. This low-cost alternative – coupled with telehealth and remote patient monitoring (RPM) capabilities – delivers a broad range of benefits from reduced readmissions and enhanced outcomes to improved chronic care management and better intelligence for managing risk and deploying timely care interventions.

While the average healthcare experience is far from what we’ve come to expect from the likes of Amazon and Apple, COVID-19, while insidious, has in its own way presented us with an opportunity to draw down the walls of healthcare’s bureaucracy and transform the industry through innovative and more efficient virtual and digital health solutions. Beyond care delivery, a range of complementary patient engagement solutions focused on access, administrative processes, and patient financial responsibility are available and serve to complement a comprehensive technology-enabled care delivery strategy. These tools provide helpful navigational resources, transparency, education, and convenience to ensure that provider schedules are optimized and consumers receive the best experience possible.

Clinically-Oriented Digital Front Door™

The “Digital Front Door™” is an ecosystem of solutions that engage with patients prior to the clinical encounter, assess their needs, and ultimately route the patient to the right provider, at the right time, and in the right modality (e.g., virtual, in-person, asynchronous, self-management, etc.). There are many different use cases and sub-segments within the Digital Front Door™ ecosystem – symptom checkers / digital diagnosis, smart wait lists, appointment reminders, self-scheduling, find-a-doc, etc. – and some of these sub-segments are seeing a heightened demand amidst the COVID-19 pandemic. Symptom checkers / digital diagnosis and virtual triage solutions, for example, are seeing a massive increase in adoption as these solutions can quickly help patients to self-treat, see an on-demand provider, or engage in an asynchronous visit versus tapping precious health system resources. Longer term, particularly as virtual visits become a mainstay in care delivery, providers and health systems will need to adopt a cohesive, end-to-end Digital Front Door™ strategy in order to expand patient access, improve clinical and administrative productivity, and increase revenue (e.g., through reduced patient leakage). We anticipate that the demand for a cohesive strategy will ultimately lead to partnerships and consolidation across the Digital Front Door™ category as vendors position themselves as the end-to-end solution to seamlessly navigate patients through provider organizations.

Key necessary underpinnings to a successful Digital Front Door™ strategy include:

- Enterprise-wide provider data management. Many health systems lack visibility into who their providers are, what they do, the types of conditions and patients they are best equipped to treat, and their availability. An enterprise-wide provider data management solution provides visibility into these items and therefore is the foundation of an end-to-end Digital Front Door™ strategy.

- Data feedback loops to enable machine learning. Establishing data feedback loops between the EHR and Digital Front Door™ solutions can provide the input needed to enable machine learning to improve the accuracy of Digital Front Door™ triaging, patient navigation, and decision support. This will drive care quality, remove cost from the system, and optimize the patient and provider experience.

- Pre-visit workflows enabling data-driven patient/provider encounters. Even if a patient is matched with the right provider, at the right time, and in the appropriate modality, the quality and efficiency of the patient/provider encounter is ultimately dependent on the provider having the patient’s information assembled and presented in an intelligent, action-oriented manner. As Digital Front Door™ solutions move patients through the health system, there is a unique opportunity for pre-service engagement and data collection and to present this information to the provider via integrations to the EHR and other clinical systems.

Customizing Care Delivery – Leveraging Virtual and Traditional Modalities

Without a doubt the pandemic has increased our awareness of telehealth and its potential staying power as a long-term, permanent fixture of our healthcare delivery system. Beyond traditional telehealth models, there are a range of delivery modalities that are growing in popularity and utilization by providers and patients alike. For instance, throughout the pandemic it has been critical that hospitals manage the scarcity of ICU beds available for severe COVID-19 cases. In this regard, innovative digital health and remote monitoring solutions help manage the worried well and lower severity patients that could otherwise be directed to self-manage or be virtually monitored from their homes. For COVID-19 and non-COVID-19 patients requiring an elevated level of care, asynchronous functionality and/or virtual visits can be easily facilitated on an on-demand or scheduled basis and eConsults and specialist eReferrals can be triggered rapidly, as appropriate. These capabilities along with more targeted virtual health deployment (e.g., telestroke, teleICU, telepsychiatry, etc.) enhance access, speed of care delivery, and allow physicians to perform at the top of their licenses.

Traditional, in-person care and medical procedures will continue to be facilitated based on need and patient preferences. However, the complementary use of customized, technology-enabled virtual care delivery will be essential to alleviating supply/demand care delivery imbalances across the country as well as sustaining the long-term financial viability of our health system overall. The following are among the major considerations in establishing virtual health as a permanent, highly utilized component within the care delivery spectrum:

- Reimbursement equivalent to in-person visits will be critical: CMS’ support for telehealth reimbursement parity during COVID-19 has been a boon for the industry. Post-COVID-19, there is an expectation (but by no means a certainty) that telehealth will be reimbursed at levels similar to an equivalent in-person visit for certain services. The longer COVID-19 and social distancing measures persist, the more data telehealth providers, CMS, and commercial payers will have to support the efficacy and safety of telehealth. This, in turn, will help solidify a more concrete view on long-term reimbursement. (As an editorial note, telehealth delivery for certain services is far less costly for the provider. Home health, for example, is a great use case for telehealth and the efficiency gains related to reduced travel time and greater patient throughput should be considered when evaluating reimbursement.)

- Payer-provider contracting will change: We expect provider-payer contracting dynamics to take into account greater telehealth utilization in the future. Providers may account for these dynamics as well and shift their operating models from a staffing, technology adoption, and real estate footprint perspective. Further, digital health vendors may benefit from new reimbursement models that require the provider to digitally diagnose and when applicable, virtually treat the patient before the payer authorizes a more costly in-person visit.

- Outcomes and clinical efficacy: The breadth and quality of telehealth provider networks will be critical to ensure adequate coverage, timely access, and high-quality outcomes for patients. Clinical efficacy – substantiated by outcomes and/or patient-reported data – will help justify equivalent reimbursement for telehealth and emerging asynchronous care delivery models and drive further adoption among major providers, payers, and employers.

- Remote and community-based diagnostics will enhance and extend virtual health’s reach: On-demand medical exam kits, at-home lab tests, and digital tools that collect patient diagnostic information will see increased demand. Patients looking to avoid the risk and long wait times at clinics and hospitals will increasingly seek to receive their lab work, tests, and treatments at less costly, community-based sites run by Quest Diagnostics, LabCorp, and CVS, for example.

- HIPAA compliant capabilities will be required: It is anticipated that secure, HIPAA-compliant telehealth capabilities will be required following the end of the COVID-19 pandemic. Security, scalability, and feature functionality will all be important technological factors moving forward from a compliance and competitive, barriers to entry perspective.

- EHR integration and interoperability will be increasingly important: For telehealth to go mainstream, the various telehealth platforms, asynchronous care delivery solutions, and digital health tools will need to integrate with the provider’s EHR system for streamlined scheduling, documentation, and billing purposes. Interoperability will be as important as ever to ensure that care coordination, quality, and the patient’s experience are optimized.

Consumer awareness of virtual health has exploded during the COVID-19 pandemic and we’ll likely see behaviors further solidify as we collectively await a vaccine or effective treatment. These dynamics will influence how traditional and virtual care delivery providers adapt to the “new normal” and compete effectively for patient volume as expectations evolve. Consumer-oriented models – whether cash pay or covered – that offer enhanced convenience, customization (i.e., tailored, concierge support and coaching), specialization (e.g., pediatrics, geriatric care, men’s and women’s health, etc.), and an overall consumer-friendly experience will find themselves well positioned to attract and retain patients.

Home-based Patient Monitoring and Engagement

There is increasing recognition in the industry of the importance of solutions that enable ongoing patient monitoring and engagement in the home in order to reduce readmissions and improve care plan and medication adherence. While this ecosystem of solutions was experiencing success and traction pre-COVID-19, adoption by payers and providers has been dramatically accelerated amidst the COVID-19 crisis. In conversations with companies and investors in this space over the past month, we are seeing demand across nearly every sub-segment depicted in the visual below. COVID-19 aside, this ecosystem is also supported by strong, macro tailwinds such as an aging population, a rise in chronic conditions, increasing focus on addressing social determinants of health, and positive reimbursement developments by CMS and commercial payers.

A few important components to the long-term success of these solutions include:

- Patient adherence and utilization. Solutions that are user-friendly, reliable, and promote high levels of patient engagement and utilization are critical. Stating the obvious, but without high levels of utilization, patient monitoring solutions do not provide value, no matter how good the underlying technology is.

- Integrated solutions. The patient / provider encounter will greatly benefit if data from RPM and other monitoring and engagement activities is available and made actionable to providers when interventions are needed and during regularly scheduled visits. In a future state, data from ongoing monitoring and engagement activities should be one of the data sources leveraged by the Digital Front Door™ and care delivery solutions adopted by health systems.

- Aligning economic incentives. Financial incentives are a powerful motivator for behavior change and adoption. In a world where providers have a broad range of economic arrangements across Medicare, Medicaid, and various commercial payers, the financial incentive for providers to adopt monitoring solutions has not always been clear. However, there are several tailwinds that are beginning to align financial incentives: CMS has released new CPT codes in recent years to incentivize providers to deploy patient monitoring solutions, many Medicare Advantage Plans are including patient monitoring as a covered benefit, and the broader shift to value-based care is driving demand.

The need (and opportunity) to reshape care delivery to create a more efficient and effective care delivery system has never been greater. TripleTree and TT Capital Partners are actively exploring the three areas explored in this blog with industry leaders and innovators, building perspectives on the sub-categories of immediate “winners” that are experiencing the first wave of demand due to COVID-19 in addition to the sub-categories that will be beneficiaries of subsequent waves of demand as the market collectively adapts to a “new normal” following the current crisis.

Stay safe and healthy and as always, let us know what you think.

“Digital Front Door” is a registered trademark of Zipnosis.

Related Blogs: