Healthcare Technology Insights

Wellness at Work: Digital Health and the Booming Wellness Industry

August 30, 2017

Since the turn-of-the century, workplace wellness has undergone a transformation. From the old model of smoking cessation programs, nurse help lines, and on-site gyms, workplace wellness has entered the 21st century with the advent of tech-enabled, incentive-based disease and risk management platforms. The wellness industry has boomed in the process with nearly 80% of employers offering wellness perks and over $40 billion in annual spending on corporate wellness. One by-product of these developments is the adoption of digital wellness platforms in the business-to-business (“B2B”) market and increased investor interest in the space, as evidenced by a number of recent high profile transactions.

Digital wellness is an emerging vertical at the intersection of the digital health and wellness markets. Often accessed via a mobile device, digital wellness platforms offer easy-to-access, affordable, and an even game-like wellness experience (more on this in TripleTree’s upcoming blog on the impact of gamification in healthcare). Platforms in the space vary, with capabilities ranging from depression and stress management, to mediation and mindfulness, to enabling employers and employees to more effectively manage and track their overall health and wellness. Many digital wellness platforms have their roots in the business-to-consumer (“B2C”) market, however, given recent industry tailwinds and changes in the workforce, digital wellness has naturally begun to transition to the B2B market.

As part of bringing workplace wellness into the 21st century, employers have begun partnering with digital wellness platforms to bolster their wellness offerings and meet the changing demands of today’s employees. According to a recent study by Deloitte, Millennials will soon make up 75% of the workforce. Today’s younger, more tech-savvy workforce is adopting wellness and digital health platforms more rapidly than previous generations. Additionally, today’s workforce places a larger emphasis on convenience than past generations and looks to access healthcare when and where they choose (a topic TripleTree discussed in a recent Industry Perspective about the impact of millennials on U.S. healthcare). Furthermore, as the benefits of a proactive approach to managing one’s mental well-being become more tangible and well known, employers and employees will look to workplace wellness programs for a solution. As such, conversations around implementing digital wellness solutions are making their way into board rooms as employers look to attract, retain, and support the next generation of workers.

Capitalizing on industry tailwinds, a number of platforms have emerged to satisfy demand and investors are buying in. Just last week, AbleTo, a teletherapy and mental-health management platform, announced it had raised $36.6 million in funding from Bain Capital Ventures and Aetna. Via its web portal and mobile app, AbleTo provides stress and behavioral health management solutions and enables face-to-face interaction between its users and a network of licensed therapists and behavioral coaches. AbleTo sells their platform into health plans and large employers and looks to put the capital to use scaling business operations.

Similarly, Happify, a TT Capital Partners portfolio company and digital behavior change platform, closed a funding round in early August, which they look to put to work scaling out their B2B enterprise wellness platform, Happify Health. Through its platform, the company dynamically personalizes the experience for each individual and becomes the engagement engine for Happify Health and partner programs/other resources in the payer/employer ecosystem. Having recently secured multiple major partnerships, Happify appears to be gaining traction in the B2B market.

Another unique platform in the space, Headspace, a provider of mobile meditation and mindfulness solutions, closed a $37 million round of funding from Spectrum Equity in late June. Headspace plans to deploy a portion of this capital into expanding its corporate partnerships business, Headspace for Teams, which enables employers to offer subsidized Headspace subscriptions to their employees. While currently a minority of revenue, the Company believes corporate partnerships may represent as much as 50% of revenue in coming years. With the post-money valuation following this round reported to be north of $250 million on revenue of greater than $50 million, investors appear confident in the new direction of the business and industry.

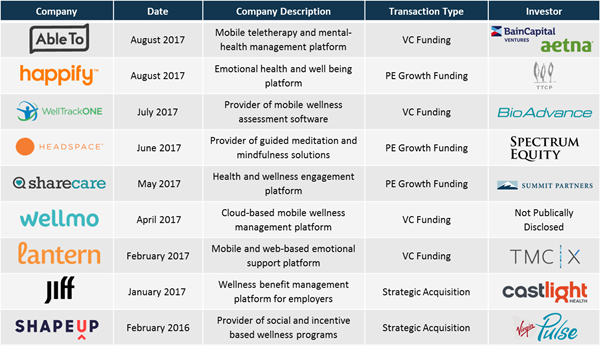

Recent capital raises and M&A activity demonstrates the significant momentum in the space. According to Rock Health, there have been nearly as many digital wellness M&A transactions in 2017 the previous two years combined. A number of recent transactions in the space are detailed below.

With an unprecedented amount of capital flowing into the digital health space, we expect to see a significant ramp up in partnerships between digital wellness platforms, employers, and payers leading to increased investor interest in this growing sector.

We will continue monitoring the space and would love to hear your thoughts.