Healthcare Provider Insights

What’s Ahead for Small & Medium Physician Practices?

July 10, 2022

In this next installment in our blog series on virtual health, we look at the impact of telehealth on small to medium-sized physician practices; primary care practices, as well as specialty groups, with 1 – 20 physicians. These practices represent an important part of the healthcare delivery system in the U.S., as they include more than half of working physicians. Like many other smaller businesses, this is a group that has unfortunately been hit hard by the COVID-19 pandemic. Many physician practices have been forced to implement layoffs, furloughs and pay cuts, with some even considering closures as they continue to accumulate losses due to decreased patient and elective procedure volumes. Although the government has stepped in to help struggling physician practices through measures like the U.S. Small Business Administration (SBA) programs and advanced payments from Medicare and other designated funds, many smaller practices have remained concerned about what the “new normal” will look like post-panedemic. This blog shares perspectives about how physician practices have adapted to the pandemic by rapidly transitioning to telehealth, how telehealth is likely here to stay and how subsequent waves of demand and innovation are evolving in physician practices. We will touch on how these practices are managing their digital front door, upgrading administrative and engagement capabilities, implementing clinically-oriented virtual care solutions and transitioning to take on risk.

Telehealth – A Lifeline for Small and Medium Physician Practices

In addition to offering financial assistance, the government instituted several key changes in regulations that sped up the transition to telehealth for physician practices. Early in April, The Centers for Medicare & Medicaid Services (CMS) expanded reimbursement to include an additional 80 telehealth services and reiterated that these will be reimbursed at parity with in-person services. Many health plans on the commercial side followed CMS’s lead of reimbursing at parity. As a result, there has been a surge in telehealth adoption and utilization by physician practices (see prior blogs highlighting these trends).

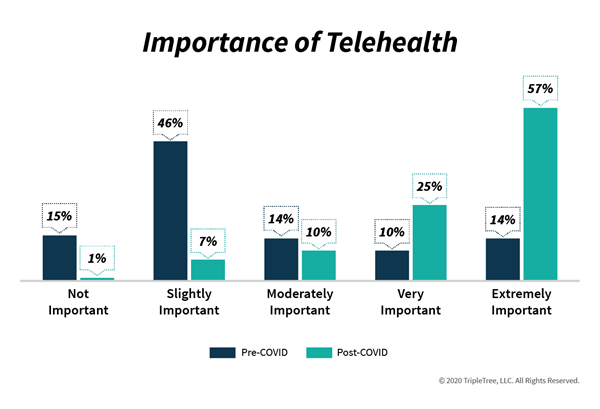

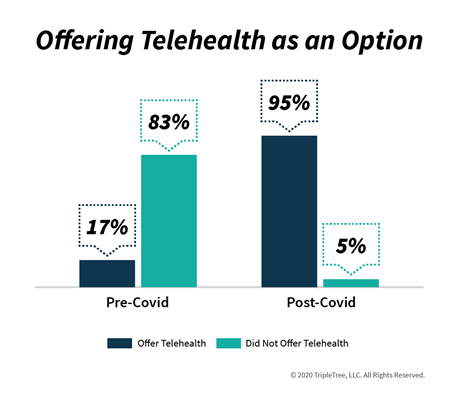

We think the key question for the industry is how sustainable this move to telehealth will be as local economies and associated physician practices begin re-opening. Updox (TT Capital Partners is an investor), works directly with approximately 8,000 practices mostly in the small and medium-sized market and as such has a pretty good pulse on the industry. In late May, Updox, along with the Harris Poll, conducted an online survey of 2,000 U.S. adults aged 18+. They found that 42% reported using telehealth since the pandemic began, and of those who used it, 65% did so because of convenience and 63% because they were worried about being exposed to sick patients. Updox also informally surveyed 400 of its users on the importance of telehealth and how they intend to offer telehealth in the future. Post-COVID-19, 82% of those polled say telehealth is very or extremely important (up from 24% pre-COVID-19) and 95% intend to offer telehealth as an option (up from 17%; further detail highlighted in the graphic below).

Another survey from Kareo found that 72% of practices plan to continue the usage of telemedicine after the pandemic, with an expectation that 24% of future visits for all specialties will be conducted virtually. We think these surveys offer strong evidence for how important telehealth has become for physician practices and how it is expected to have staying power.

Expanding Beyond Virtual Visits

As telehealth becomes a mainstay modality of care for physician practices, groups are now recognizing the need for additional solutions that can better integrate telehealth into their front-office and back-office workflows. These additional solutions are being coined as “Digital Front Door” and/or “Virtual Waiting Room” and span across administrative, scheduling, billing/payment, and patient communication capabilities.

A growing number of innovative companies are now providing these broader capabilities to physician practices, including:

- Clearwave – electronic patient check-in system

- Kareo – EMR for independent physician practices with many embedded patient engagement solutions

- LumaHealth – automated patient communication, scheduling and telehealth platform

- Millenia – patient financial engagement and payment experience software

- Relatient – patient engagement software to help providers fill their schedule, reduce no-shows and improve patient experience

- SolutionReach – patient relationship management software designed to improve communication, engagement and access

In addition to “Digital Front Door” solutions, more clinically-oriented virtual health technologies, specifically virtual eConsults, are growing in importance. These are physician-to-physician interactions – generally primary care to specialists – that lower costs and improve patient satisfaction by preventing unnecessary specialist visits. This allows specialists to focus on practicing at the top of their licenses by keeping the less complex cases out of their offices. It also equips primary care physicians to function as the true “quarterback” of care and treat patients more holistically by avoiding unnecessary specialist referrals. Leading vendors in eConsults include RubiconMD and AristaMD.

Accelerating the Transition to Value-Based Care

Some also are arguing that the COVID-19 pandemic exposes the weaknesses of the fee-for-service model and providers’ reliance on elective procedures for financial viability. Although initially some thought that the pandemic would slow down the shift to value-based contracting arrangements, as the pandemic continued, it became clearer that practices at the forefront of value-based contracting would re-emerge stronger. When providers take risks and function more like payers, these providers are able to reap the financial rewards during periods of deferred care. We think that the pandemic may ultimately serve as an historical turning point and push providers to greater adoption of capitated arrangements and other value-based care approaches.

We believe not every physician practice is prepared to take on risk, and much care and consideration should be taken before entering into risk-based contracts. Physician practices require specialized tools including risk underwriting, data analytics, care management and transitions of care before taking the leap to risk-based contracts. Fortunately, there are navigation companies for this journey, and below we highlight a few of them:

- Agilon Health – develops integrated clinical administrative and technology solutions for physicians and healthcare providers

- Aledade – provides services to primary care physicians to form and operate accountable care organizations (ACO)

- Caravan Health – builds and manages ACOs for health systems but have thousands of physician group participants making implementing value-based care strategies

- Navvis (TT Capital Partners is an investor) – accelerated efforts of equipping practices to take on risk through the Nov ’19 acquisition of HealthSync

In closing, small and medium-sized physician practices have represented one of the most challenged sectors of the care delivery system during the pandemic. Important government assistance and changes to workflow, mostly around telehealth, sustained many practices during the pandemic. Key questions remain around the staying power of telehealth and the longer-term trends in payer reimbursement. We see several potential workflow changes that will impact how this plays out in the long-term including physician practices dedicating one day a week as a “virtual-only” day, which has the potential to dramatically increase panel size and overall revenue. Another development could be the re-organization of care delivery around populations, not physical practices, with small teams taking responsibility for a fixed population. Physician practices may also be looking to tack on other incremental sources of revenue, which could include offering behavioral health. Finally, we might expect to see the industry more quickly transition to risk-based care.

We’ll be tracking these trends and more and welcome your dialogue on this important topic!